In the interest of full disclosure, OMAAT earns a referral bonus for anyone that’s approved through some of the below links. These are the best publicly available offers (terms apply) that we have found for each product or service. Opinions expressed here are the author's alone, not those of the bank, credit card issuer, airline, hotel chain, or product manufacturer/service provider, and have not been reviewed, approved or otherwise endorsed by any of these entities. Please check out our advertiser policy for further details about our partners, and thanks for your support!

There are many benefits to making purchases with credit cards, ranging from the ability to earn rewards, to purchase protection. For those of us who are frequent travelers, having a credit card that offers travel coverage is essential.

Earlier this year I had a trip where I misconnected, forcing an overnight layover. Fortunately I paid with The Platinum Card® from American Express (review), which offers a fantastic trip delay insurance benefit. While I found the whole claims process to be a bit time consuming and cumbersome, it worked out in the end, and that’s what counts.

In this post I figured I’d outline my experience, because I know many people will likely go through the same process.

While the Amex Platinum offers a variety of coverage benefits, I’ll be focusing specifically on the trip delay insurance coverage, since that’s what I used, and where I can share my firsthand experience. While you’ll want to consult the Guide to Benefits to read all the fine print, let’s talk about the basics of the coverage.

With Amex Platinum trip delay insurance coverage, you can be reimbursed up to $500 per covered trip for necessary expenses when your trip is delayed for more than six hours. You can claim this benefit up to two times per eligible card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Here are what I consider to be the most important terms to be aware of:

Let me emphasize that I’m just trying to hit on the key points here. You’ll want to read the full Guide to Benefits for all the details, because there’s obviously a lot of fine print (as there is with any insurance policy).

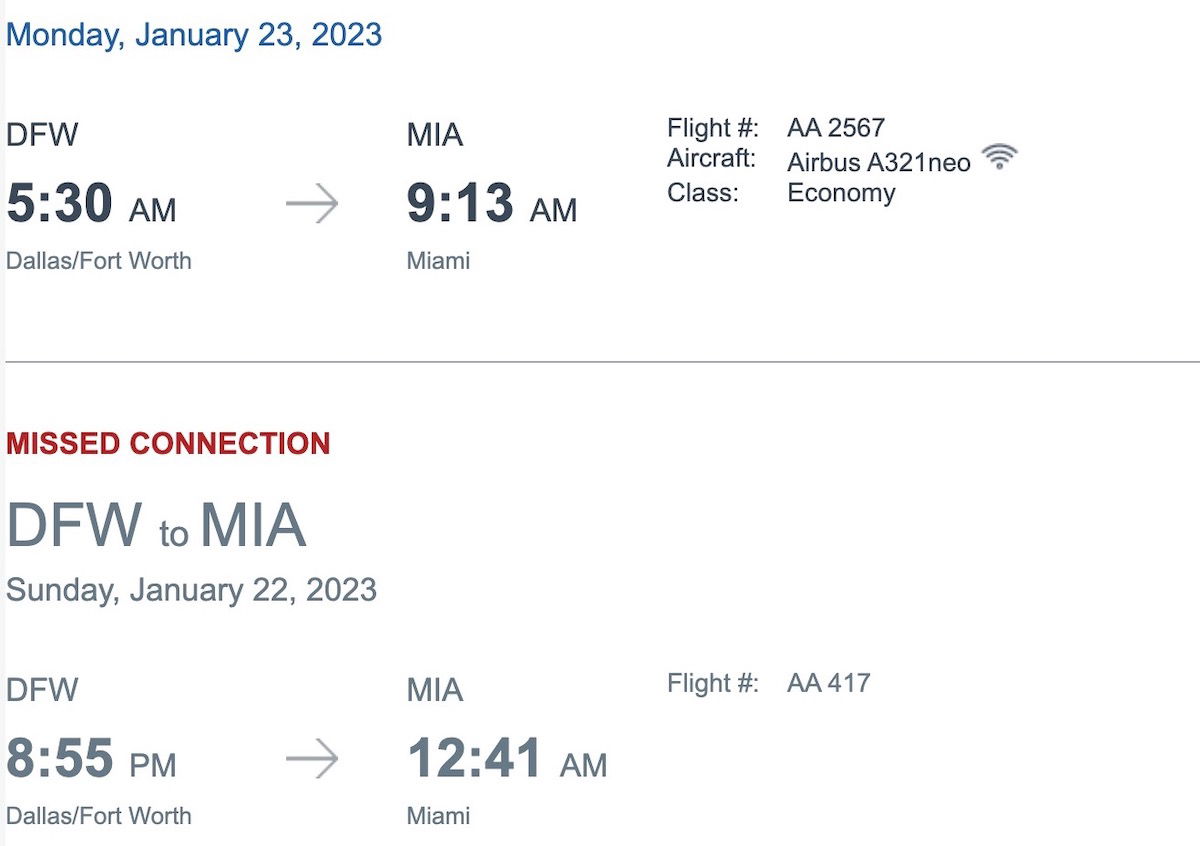

This claim actually dates all the way back to an itinerary I had on January 22, from Puerto Vallarta to Dallas to Miami. I was supposed to have a roughly two hour connection in Dallas, but due to a maintenance issue in Puerto Vallarta, the flight was delayed, and I ended up misconnecting.

The Dallas to Miami flight that I was booked on was the last flight of the evening, so I was rebooked on a 5:30AM flight the following morning.

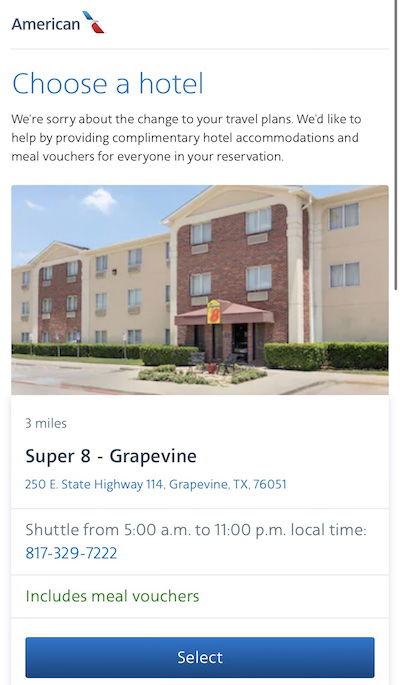

Now, since this delay was within American’s control, I was offered a hotel accommodation… at the Super 8 Grapevine. It’s pretty disappointing what American offers an Executive Platinum member traveling in paid first class, especially when you consider that some decent hotels near the airport weren’t unreasonably priced.

DFW happens to have one of my favorite airport hotels in the world, the Grand Hyatt DFW, which is connected to the terminal. I had pondered just redeeming points there, because it’s so much more convenient. I then wouldn’t have had to wait for a shuttle or pay for an Uber to & from the hotel, not to mention I’d have a much more comfortable stay.

But I didn’t even need to do that. The beauty of credit card insurance is that I was covered in this case. There’s nothing in the terms stating that you have to accept the hotel an airline offers you, but rather you just can’t double dip, and request reimbursement from multiple sources.

So I booked the Grand Hyatt DFW (which was running around $300), and then ordered room service as well (which cost around $100), knowing that would be covered (for the record, Ford was with me, so the food wasn’t all for me). 😉

The process of being reimbursed as part of this coverage consists of three steps, all of which are handled by AIG, Amex’s benefits administrator:

Let me share my experience with each of these steps.

To kick off this process, you first need to file a claim within 60 days of your disruption. This has to be done by phone, by calling 844.933.0648. The phone call took around 15 minutes, and I was asked to provide some basic details about my trip, as well as the interruption I experienced, including how, why, and when I misconnected.

This is just intended to establish the basic details of the claim, and then you’ll be sent an email with a case number, and all the documents you have to complete.

Okay, to be honest, they don’t make it easy to file all the required documents, but then again, which insurance policy does? I’d say the process of gathering documents, filling out all the paperwork, and submitting them, took me around an hour, and I’m usually pretty fast.

What all is required?

I was a little worried about that last point, as the form stated that I had to show “additional expenses purchased on your Eligible American Express Card,” though I used another card. Fortunately IAG confirmed that this was okay, and I just needed to submit proof of that billing statement.

Gathering all these documents and filling out these forms took a bit of time. On top of that, AIG has a 14MB limit on how big emails can be, so you may have to resize some files, or send multiple emails.

I found it odd that when I submitted my email, there wasn’t any sort of an automated email response confirming that my documents had been received. I only mention that because I was pretty close to the 14MB email limit, so I wanted to make sure I didn’t do anything incorrectly.

I also sent an email to confirm my initial had been received, but never received a response. However, when I called a couple of weeks later (and waited on hold for 20 minutes), an agent confirmed that my documents had been submitted, and were being reviewed.

In the end it took around six weeks for my claim to be approved, and then the check arrived around a week after that.

The Amex Platinum Card offers valuable trip delay insurance, whereby you can be covered for up to $500 in necessary expenses when your trip is delayed by at least six hours. When I misconnected at DFW earlier this year, it seemed like the perfect opportunity to give this coverage a try.

I’m happy to report that it worked exactly as planned, and I was reimbursed the full cost for my hotel room and dining at the hotel.

I’d say there are two major things to be aware of. First of all, the process of filing a claim is fairly time consuming, so expect that altogether you’ll likely spend a couple of hours on this. Furthermore, don’t expect the claim to be processed quickly, as it will likely take several weeks.

If you’ve used Amex’s trip delay insurance benefit, what was your experience like?